How Do You Look Up Who Owns A Property

Tax Administration and Property Records

Island property owners reminded of property tax payment options ... Social links. Facebook · Instagram · Subscribe · Twitter · Flickr · Youtube · Linkedin. ...

https://www.princeedwardisland.ca/en/topic/tax-administration-and-property-recordsProperty Search – OnLand Help Centre

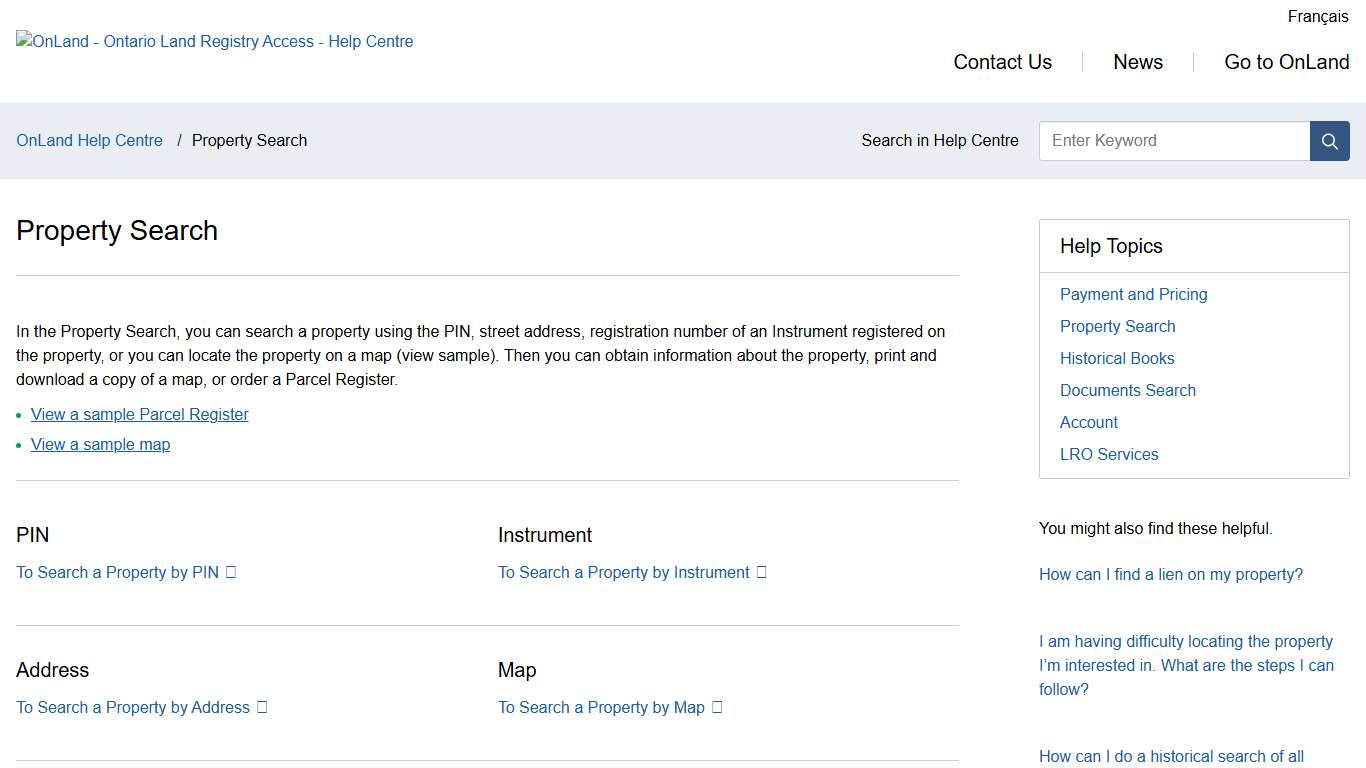

In the Property Search, you can search a property using the PIN, street address, registration number of an Instrument registered on the property, or you can locate the property on a map (view sample). Then you can obtain information about the property, print and download a copy of a map, or order a Parcel Register.

https://help.onland.ca/en/property-search/

Government of Prince Edward Island

Health Services Impacted by Weather - January 27, 2026. Read about the full ... Find tax and property info · Virtual Health Care for Islanders · Efficiency ...

https://www.princeedwardisland.ca/enCalgary property tax assessments sent; review until March 23

The City of Calgary says the typical residential property owner will see a one per cent increase in the value of their property when they receive their latest assessment. Officials made the announcement on Thursday while releasing details about 2026 property assessment notices, which are now in the mail.

https://www.ctvnews.ca/calgary/article/2026-property-tax-assessments-everything-you-need-to-know/Find land titles, documents or plans Alberta.ca

Effective September 15, 2025, Land Titles and Surveys in-person Client Service counters in Calgary and Edmonton will be closed to help address a backlog of submissions. Support continues to be available through phone and email. Overview Most titles, documents or plans can be ordered through the Alberta Registries Spatial Information System (SPIN2), Alberta Registry for Land Online (ARLO) or through a registry agent.

https://www.alberta.ca/find-land-titles-documents-plans

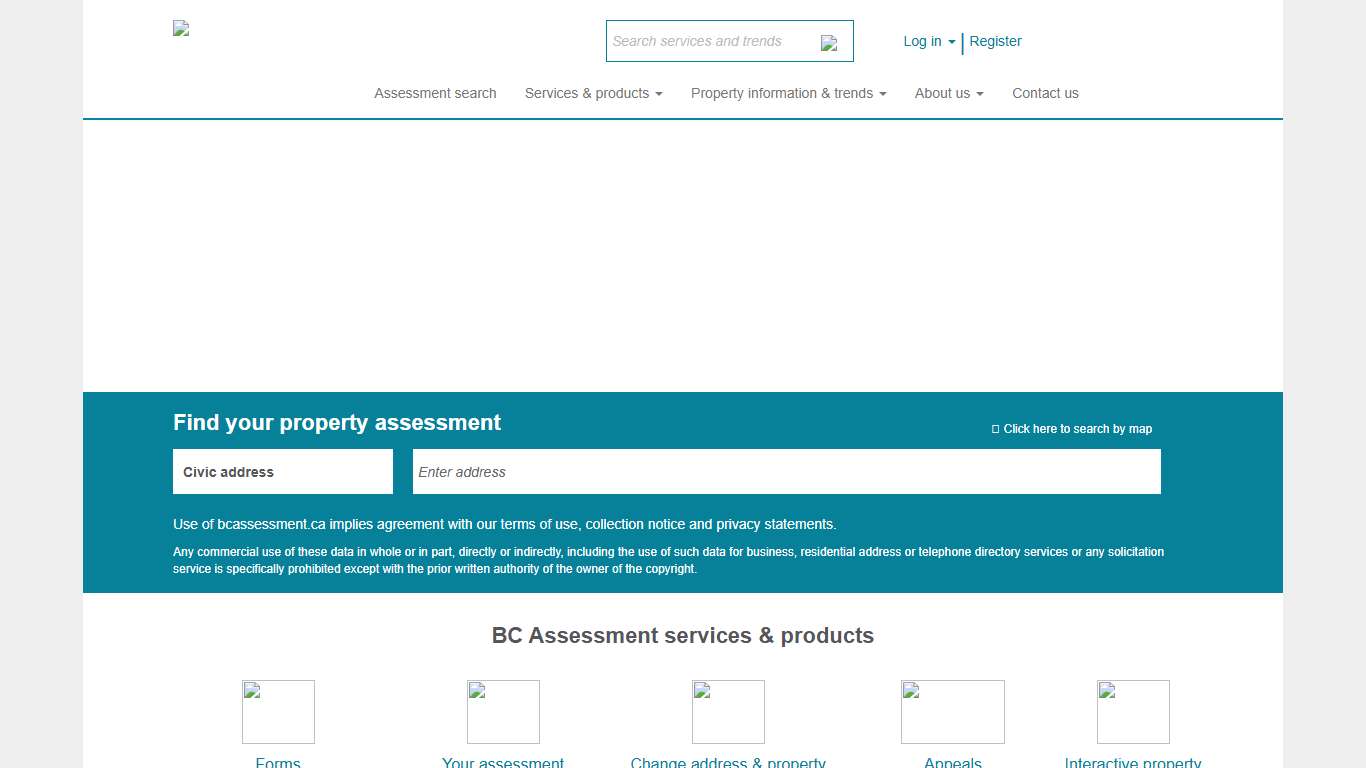

BC Assessment - Independent, uniform and efficient property assessment

Find your property assessment Any commercial use of these data in whole or in part, directly or indirectly, including the use of such data for business, residential address or telephone directory services or any solicitation service is specifically prohibited except with the prior written authority of the owner of the copyright.

https://www.bcassessment.ca/

Welcome to MPAC MPAC

To give you the best experience on our website, we may use cookies and pixels to track visits and interactions, optimize our services, personalize content and to keep the site secure. Cookies and pixels do not contain personally identifying information and do not give MPAC access to anything on your device.

https://www.mpac.ca/en

Property Tax Lookup – City of Toronto

By using this application, you acknowledge that the City provides the application on an "as is", "as available", basis. The City does not make any express or implied warranties, representations or endorsements with respect to the application. In particular, without limiting the generality of the foregoing, you acknowledge that: The information provided through the application: - may not reflect the true or current balance of your property tax ...

https://www.toronto.ca/services-payments/property-taxes-utilities/property-tax/property-tax-lookup/

Home - LTSA

The Land Title and Survey Authority of British Columbia Features Learn more about the people and the history of LTSA on our YouTube channel. We couldn’t have achieved any of our success without key stakeholder and customer relationships in the real property market and the people we are proud to call our team.

https://ltsa.ca/

BC Assessment - Independent, uniform and efficient property assessment

Find your property assessment Any commercial use of these data in whole or in part, directly or indirectly, including the use of such data for business, residential address or telephone directory services or any solicitation service is specifically prohibited except with the prior written authority of the owner of the copyright.

https://www.bcassessment.ca/

Assessment of Properties City of Edmonton

The City uses the assessed value of your property to calculate the amount of provincial education and municipal property taxes you pay in proportion to the value of the real estate you own. A change in assessed values affects property taxes in the following manner: Average assessed value change = Average municipal tax increase If your property’s value change is similar to the average, city-wide assessed value change, you will...

https://www.edmonton.ca/residential_neighbourhoods/property-assessment

Canada’s housing market forecast update - RBC Economics

Canada’s housing market has faced significant challenges this year. A trade war disrupted what had been an early recovery in demand for existing homes, driving transactions to cyclical lows this spring and pushing down property values, particularly in Ontario and British Columbia.

https://www.rbc.com/en/economics/canadian-analysis/canadian-housing/special-housing-reports/canadas-housing-market-forecast-update/

Home owner grant - Province of British Columbia

The home owner grant reduces the amount of property taxes you pay each year on your principal residence. The grant is available to homeowners who pay property taxes to a municipality, or to the province if they live in a rural area.

https://www.gov.bc.ca/homeownergrant

Property tax City of Vancouver

Access your property tax account The fastest and easiest way to access your account and declared property status. Set up an online account. You will need your access code. It can be found on your tax notice. Property tax due dates Advance taxes: February 3, 2026 Main taxes: July 3, 2026 Home owner grant: July 3, 2026 (Grant may be claimed once the main tax notice is received.)...

https://vancouver.ca/home-property-development/property-tax.aspx